We stated that, “Since either expanding the accumulation phase or setting a minimum sum balance would result in unpopular delayed pay-outs, other solutions must be found to compensate for the shortfall in savings for old age among the low-income group” (p164).

Among the solutions discussed in our limited interactions with the provident fund in those days, a progressive dividend rate was heavily resisted as it was deemed unfair to provide different returns for the different segments of Employees’ Provident Fund (EPF) contributors.

As such, I view with amusement the speed of the fund in implementing the Conventional Savings and Syariah Savings in 2016 that has resulted in lower dividend returns for the latter.

EPF could have easily introduced different portfolios of funds according to their

risk-adjusted performance returns for different age or socioeconomic groups, and the issue of tiered dividend structure would have mattered naught. As recent as late March 2021, the then chief executive officer, Tunku Alizakri Alias, remained uncommitted to the idea, seeking to let the government and EPF members make such hard decision calls.

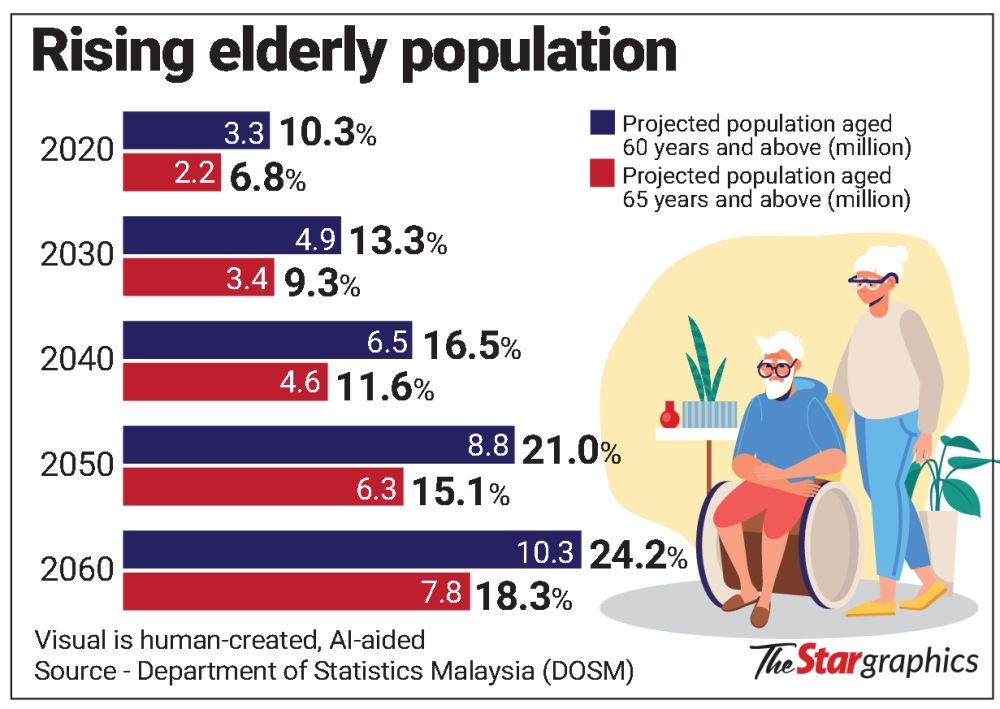

We all know where the special EPF withdrawals have since taken us to the present. Truth is, the problem of inadequate EPF savings for retirement has been around for a long time (Ong and Hamid, 2010).

Back in 2014, Prof Dr Robert Holzmann, the second holder of the Old Age Financial Protection Chair, funded by EPF at the Social Well-being Research Centre at University of Malaya (previously the Social Security Research Centre), published a thorough review of the EPF, and examined contributors microdata of the provident fund.

In his World Bank discussion paper, Holzmann called for the transformation of EPF as a retirement savings investment fund to a fully-fledged pension fund. The rationale is clear and simple, a lump-sum payout is not in the best interest of contributors and stakeholders.

In a minimum reform scenario with seven suggestions by Holzmann, not a single one was fully acknowledged and acted upon in earnest despite long-standing issues pointed out by many other researchers. In his call to reduce overall contribution rate and introducing a contribution ceiling, Holzmann wrote: “International experience suggests that contribution rates beyond 20% for retirement income purposes risk becoming counter-productive.

“The contribution ceiling has the purpose of giving room to voluntary retirement savings and limits the role of government for individuals, with income that is, say two or three times the national average.”

Perhaps more critically, Holzmann asked the question - is low wages really the only factor to be blamed? The repeated withdrawals from Account 2 for various purposes have created a leaky bucket phenomenon that nobody wants to address.

Consider the excerpt from Ong and Hamid in 2010: “Besides this, the argument about the adequacy of the EPF savings has long been discussed and debated. The pre-retirement withdrawal from EPF may need to be reconsidered so that savings remain as savings for old age.

“Therefore, for EPF to generate an adequate level of savings for retirement, the Account I should have sufficient density of contribution, if the government is unable to convert EPF payment into an annuity scheme. As for Account 2, the amount of contribution should be kept low with restricted permissible withdrawals.”

At the Malaysian Research Institute on Ageing, Universiti Putra Malaysia, we have run our own projections using the EPF calculator in 2015, with modest assumptions and there is sufficient basis for the leaky bucket phenomenon, and the need for more redistribution and risk-pooling policies within the EPF.

The biggest hurdle perhaps is public understanding, political will and greater discourse on the subject, as Malaysians are more attracted to soundbites than substantive policymaking based on evidence as well as learning from experience of other countries

(eg. Sweden, Finland, the Netherlands, Australia and Denmark).

Singapore’s CPF (Central Provident Fund), while sharing the same historical origins as EPF, has made leaps and bounds with its constant tinkering (eg. CPF Life) and the CPF ordinary wage ceiling for employees was put in place as far back as in the 1980s.

It is capped at S$6,000 (RM18,631) per month at present, meaning that CPF contributions are only deductible up to that amount, putting more money into the hands

of high-income earners for take-home consumption or to be invested elsewhere at their own risk.

Meanwhile, in Malaysia, we cannot get proper commitment or timeline to align EPF withdrawals to the “new” retirement age of 60.

We need to ask the hard questions so that EPF works for the general population, not just for the rich and wealthy.

However, even major redistribution on EPF returns will not remove the fact that compounded interests from EPF retirement savings means that high-income earners will always benefit more from tax exemptions and risk-free investments alone.

The low-hanging fruit is to first introduce a contribution cap or ceiling, and the more painful long-term reform is to annuitise the payouts, or at least annuitise a minimum sum. Older account holders should get higher dividend returns, especially if they have insufficient balances, but this is only justifiable for lifetime low-income workers, not wilful spending depletions.

If there are to be grandiose overhauls to the social protection system, we need more careful and balanced discussions and arguments, with evidence presented at the revived Social Protection Council.

There is a lot of room for improvements and reforms, but we must consider different alternatives and learn from the experience of other countries, not just simple defined benefit or defined contribution systems, but notional accounts, as well as a mix of approaches that are more equitable and sustainable.

Occupational pensions augment basic pensions, or else we are perversing the idea and value of labour.

The EPF is a mandatory occupational retirement savings plan, and in recent years, its foray into housewives (but not househusbands) and disaster relief are perplexing diversions.

Our pensions system needs to be improved, and a piecemeal approach risks incurring more new problems than solutions in the future. The EPF is a major instrument for retirement savings, but the social protection system is more than just social assistance and social insurance, but also labour market intensive.

We have made some progress with minimum wages, minimum retirement ages and unemployment insurance, but we have not really cracked the core problem.

I would like to end with a quoted paragraph from the Institute of Gerontology’s 2015 letter to the press:

“We need to move beyond simplistic solutions and challenge ourselves to think outside the box once in a while.

“However, everyone should realise that a more precise solution is also usually a more complicated one. This means that EPF’s way of managing the funds may have to change and be adjusted from time to time, just as what they have been doing all this while.

“It is not as simple as crediting every account with 6% (or more) dividend every year. Tweaking around the wage ceiling, dividend returns or accounting practices will mean more work all around, sometimes with unintended consequences.”

This article was written by Mr. Chai Sen Tyng

|

|

Chai Sen Tyng

Senior Research Officer

Tel: +603 - 9769 2740

Faks: +603 - 9769 2744

E-mail: chai@upm.edu.my |

This article was published by The SUN on 10 January 2022

.png)